Financial Independence / Retire Early or FIRE. You’ve probably at least run across this concept, or you may be an avid practitioner. (If the latter, I would love to get your reflections on it.)

Since I’ll be 63 in a couple of weeks and still working, I can safely say that I have not taken the FIRE approach. I considered it when in my late 40s but rejected it, a topic I’ll touch on in the next post.

So, as a non-practitioner of FIRE, I approach it from a certain distance and reflect on what I see as its pros and cons. In this post I present the benefits and in the next post the costs of FIRE.

You begin to invest early in life, dramatically increasing your eventual wealth

Many young adults do not focus on saving and investing money while still in school or in training or even during the first years of being a fully-fledged professional making ‘good money.’ Thus, many of us lose out on the ‘miraculous’ effects of compounding interest or stock market rises. For a person adhering to FIRE, their journey to financial independence may have started early, in college, or perhaps even earlier. A few thousand dollars invested from family gifts accumulated during childhood and adolescence, if invested early, may turn into hundreds of thousands of dollars by the time retirement is considered.

FIRE is a lifestyle, that gives you a clear goal and guiding purpose

Some individuals adhering to the FIRE approach are very into it. It is not only a way of achieving financial independence, but also an ethos, a lifestyle, an overarching goal and purpose that guides daily decision-making. FIRE is something to mind and act in the light of. It also allows FIRE practitioners to connect with others with the same focus. It can lead to a sense of belonging and connection, an opportunity to form friendships, and attend events of the like-minded.

Practitioners of FIRE choose wisely and decrease frivolous purchases

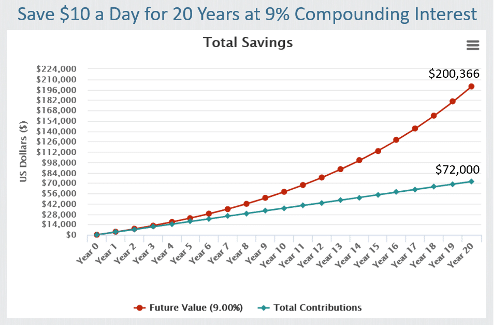

When we go about making everyday purchases, not one of them appears as a ‘make or break’ way of spending money. Almost all of them are low dollar amounts and, thus, appear inconsequential in the longer term. When living the FIRE ethos, the person sees the value of each small dollar amount, accurately perceiving its long-term value as well as the value of the amount spent on these small purchases in aggregate. Below is an example of how small daily dollar amounts add up over time. With this in mind, it is much easier to brew your coffee or bring a sandwich to work rather than purchase one. (Aside from the fact that if you make your sandwich, you have control over the ingredients you choose and can make healthier choices.)

You may avoid the traps of chasing status

When you don’t have an overriding reason to be mindful of what you spend, it is much easier to make purchases whose (often unacknowledged) purpose is to display status. Do you need a house with 10,000 square feet and a colonnade? Maybe you do. It’s fine to spend your hard-earned money as you see fit. If you have a clear vision of retiring early, however, it is easier to stop to reflect and, perhaps, choose something less expensive.

And, FIRE aficionados achieve status within their ‘in’ group by saving and investing more than anyone. So, they also chase status, but an alternate one.

You may work fewer hours over a lifetime

You may have spent most of your career thus far working longer hours than were healthy for you and your relationships with family and friends. With the FIRE approach, if you don’t overdo it in the early years and thus become burned out and fail to establish outside meaningful relationships, you can end up working fewer hours over a lifetime. This time freed up from working can be used to pursue other meaningful activities.

Being frugal opens up opportunities you may otherwise miss

If FIRE goals are balanced by living fully and meaningfully before achieving retirement, then the FIRE adherent may engage in just as many fun and meaningful activities as someone not mindful of spending as little as possible.

As I already mentioned, cooking and baking your food is often both cheaper and healthier than restaurant food or other prepared foods. Developing such cooking skills also allows the FIRE practitioner to invite family and friends to meals at their home. Such an approach opens up new vistas for convivial interactions that those not focused on wise spending habits might never think of.

Similarly with travel: if you want to spend less, you may actually take more interesting vacations. Because of fond memories from my youth traveling around the world, I still sometimes stay at hostels. (I’m glad they’re no longer ‘youth’ hostels because they would be closed to me.) Hostels are absolutely NOT for everyone, but I love their vibe. They are the only lodging that allows me to meet interesting people outside my usual social circle and age group. My favorite hostels are along the California coast. Top of my list is the hostel at Point Reyes in Marin County north of San Francisco. I wake up, eat, pack a lunch, and start walking the 2 miles to the beach. It never gets old.

Thanks. If you have your own stories about FIRE, please write me. If you’re open to it, I’ll include them in this eNewsletter, either under your name or anonymously – your choice. I’ll be back next week with the potential downsides of FIRE.

Take care,

Dr. Jack

Language Brief

“Too many people spend money they earned to buy things they don’t want to impress people they don’t like.” – Will Rogers

“Risk comes from not knowing what you’re doing.” – Warren Buffett

“I am my problem, therefore I am also my solution.” ― Najah Roberts

“Financial freedom doesn’t mean to be free from money troubles. Financial freedom actually means freedom from obsession of dollar bills.” ― Abhijit Naskar

Leave A Comment